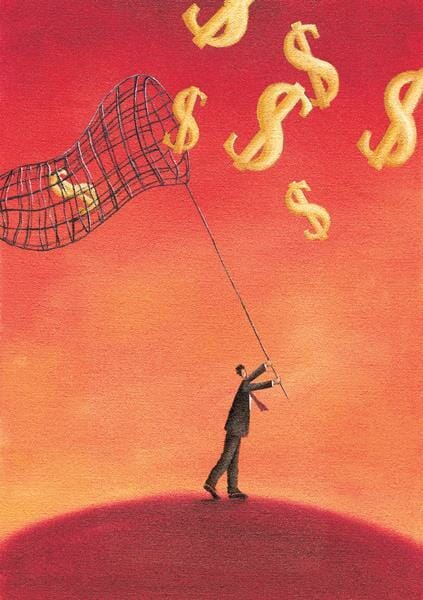

Wealth Management

Income Strategies for Retirement – Five Common Considerations

How much money will you need to retire? Do you have a financial plan to help you meet the needs of retirement? Do you have enough assets to last a retirement of 20 to 30 years? Do you have a “Retirement Income Spend-Down Plan”? These are actually loaded questions; many factors are involved and a…

Read MoreFlorida Real Estate Market Heats Up

Much like the major stock market indices in early March, the Florida housing market seemingly wants to keep climbing higher and higher. At least that’s one way to read Florida’s real estate industry as it roared into the Spring buying season

Read MoreTips and Tricks for Filing Your Taxes

Whether you decide to do your taxes yourself or go to a professional, you’ll need to get organized first. Make sure you have all your forms (W-2s and 1099s) and start making a list of any payments that might be deductible (such as moving costs) if you haven’t already.

Read MoreFlorida Retirement Real Estate Rebound

Autumn might be in the air in some parts of the country but it still feels like summer in Florida. That’s especially the way it feels in Florida’s red-hot real estate market.

By Scott Kauffman

Read MoreTax Friendly States

Planning your retirement is an important life decision. After all, you have worked hard for it, so you want to make the most of the opportunity. Deciding on all the personal preferences you want in your retired life comes first-golf courses, fitness centers, the beach-but once that is figured out it is time to move on to the less thrilling, but equally important side of things. Money.

Read MoreThe Importance of Preparing for Long Term Care

The reality is, the longer you live, the greater the likelihood that you may require long term care. The costs associated with long term care are significant. While it can take decades to accumulate the assets you need to comfortably retire, just a couple of years paying for long term care may threaten a lifetime of savings.

Read MoreTax Friendly Pension States

Staying one step ahead of Uncle Sam is extremely important for retirees living on pension benefits. Tax implications on pensions vary depending on the type of pension and the state where you live. One of the best ways to protect your fixed income payments is to move to a tax friendly state where you can…

Read MoreTop 10 Myths About Retirement

“The times they are a-changin’.” I’m pretty sure Bob Dylan wasn’t talking about retirement when he sang these famous words, but he sure could have been. Retirement planning, including all of the non-financial aspects, needs to be done quite differently today.

Read MoreBuying a Second Home in the U.S.: What Foreign Nationals Need to Know

The credit crunch, glut of homes on the U.S. market and sellers’ eagerness to deal has created some fantastic opportunities for foreign nationals with solid capital. Snowbird buyers from Canada and the United Kingdom are taking advantage of this opportunity in droves, flocking to the warm climates of Arizona, Nevada, California and Florida.

Read More