Tax-Friendly States for Retirees

Tax-Friendly States for Retirees

"The hardest thing in the world to understand is the income tax."

- Albert Einstein

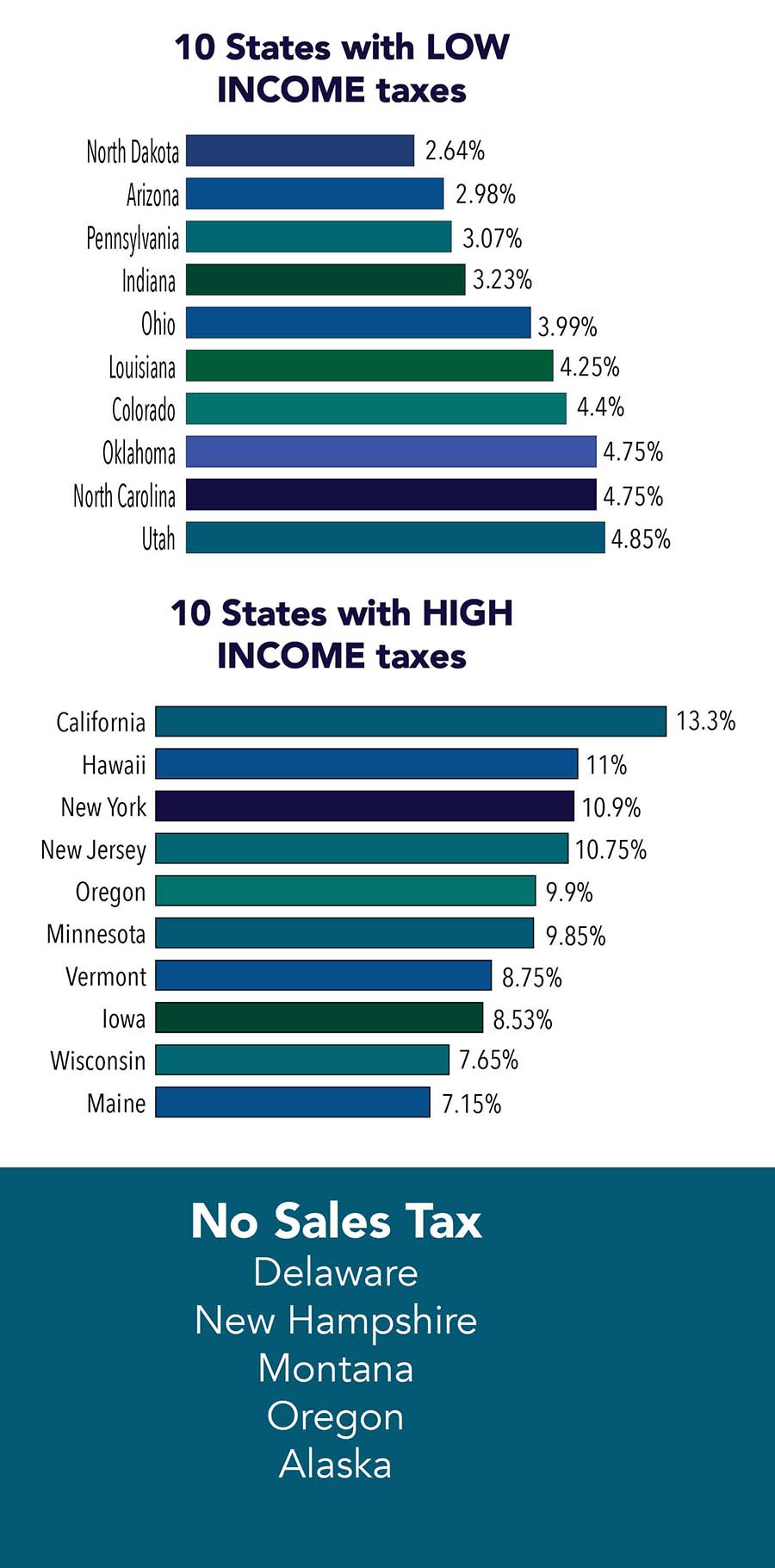

At Ideal-LIVING, we believe that lifestyle is the most important reason to change your location. Yet, our surveys show the quest for lower taxes is a leading motivator for our readers. While several states have no state income tax, many are tax-friendly, even if they might tax income. Each person's financial situation is different, so it's always best to discuss your needs with an accountant or financial planner. With that in mind, let’s explore the best tax friendly states for retirees looking to relocate.

Pros of living in a no-income-tax state:

Save money on income taxes

The most obvious benefit of living in a no-income-tax state is that you will not have to pay state income tax on your earnings. This can save you a significant amount of money, especially if you are a high-earner.

Simpler tax preparation

Filing your taxes is typically easier if you live in a no-income-tax state since you do not have to worry about calculating your state income tax liability.

Attract businesses and residents

States with no income tax often have stronger economies, as they are more attractive to businesses and residents. This can lead to more job opportunities and a higher quality of life.

Cons of living in a no-income-tax state:

Higher sales and property taxes

States with no income tax often have higher sales and property taxes to compensate for lost revenue. This means that you may end up paying more in other taxes, even though you are not paying state income tax.

Lower government spending

States with no income tax typically spend less on public services such as education, infrastructure, and social programs. This can lead to lower-quality schools, roads, and other public services.

Less tax revenue for local governments

Local governments often rely on state income tax revenue to fund their operations. This means that states with no income tax may have lower tax revenue for local governments, which can lead to cuts in local services.

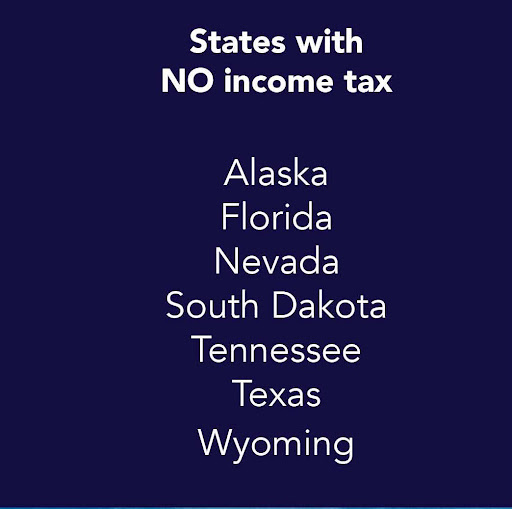

States with NO Income Tax

Choosing a state with no income tax can significantly boost your financial freedom in retirement. States like Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, and Wyoming offer the allure of keeping your entire paycheck. These states compensate for the lack of income tax in various ways, so it's essential to consider the overall tax burden. These destinations not only promise financial benefits but also diverse lifestyles, from Alaska's wild frontiers to Florida's sunny beaches.

- Alaska

- Florida

- Nevada

- South Dakota

- Tennessee

- Texas

- Wyoming

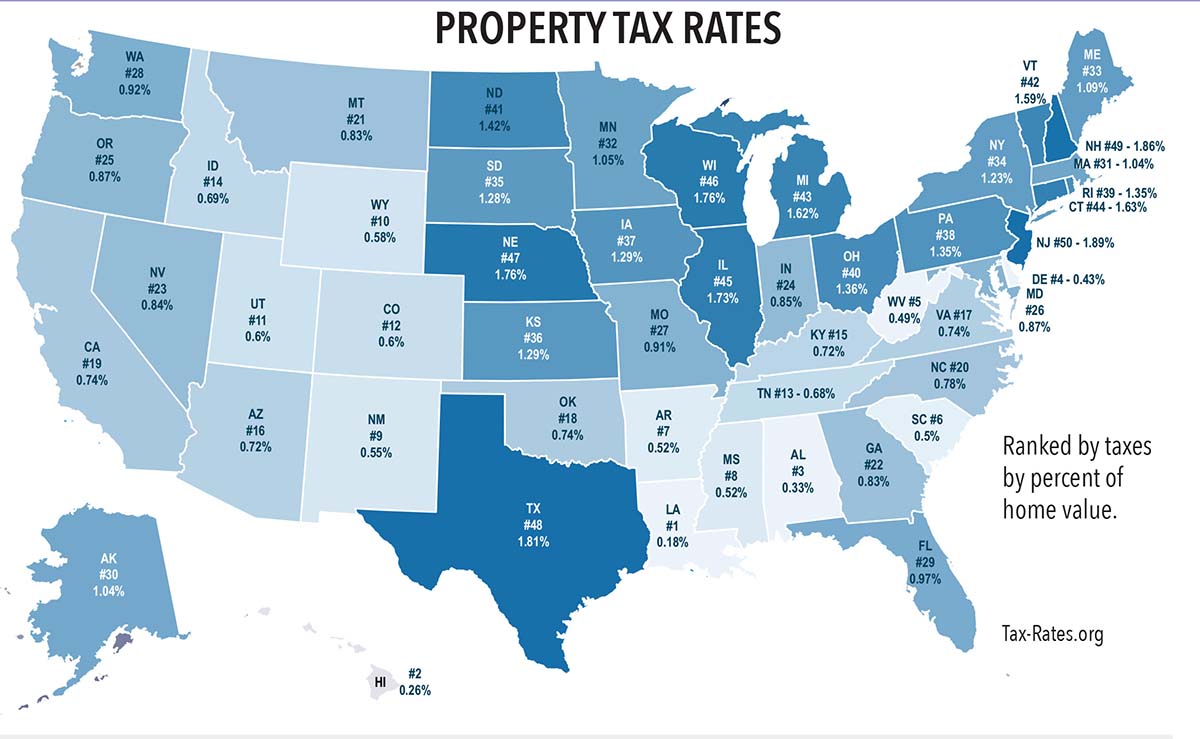

10 States with the Highest PROPERTY Taxes

While some states are tax havens, others levy higher property taxes. States like New Jersey, New Hampshire, Texas, Nebraska, Wisconsin, Illinois, Connecticut, Michigan, Vermont, and North Dakota typically have the highest property taxes. This can impact your retirement budget, especially if you own a larger property or plan to. However, these states often provide robust public services and infrastructure, which can enhance your quality of life in other ways.

- New Jersey

- New Hampshire

- Texas

- Nebraska

- Wisconsin

- Illinois

- Connecticut

- Michigan

- Vermont

- North Dakota

10 States with the Lowest PROPERTY Taxes

On the flip side, states like Louisiana, Hawaii, Alabama, Delaware, West Virginia, South Carolina, Arkansas, Mississippi, New Mexico, and Wyoming are known for their low property taxes. This can be a boon for retirees looking to stretch their savings further. Each of these states offers its unique charm and living experiences, from the warm southern hospitality to the tranquil beauty of Hawaii.

- Louisiana

- Hawaii

- Alabama

- Delaware

- West Virginia

- South Carolina

- Arkansas

- Mississippi

- New Mexico

Property Tax Rates by State

Property tax rates vary significantly across the U.S., and they can be a deciding factor when choosing your ideal retirement state. States with higher property taxes often fund more comprehensive public goods and services compared to those with lower tax rates. Understanding these rates in relation to the overall cost of living and the lifestyle you seek is crucial in making an informed decision for a blissful retirement.

Why Live in a State With No Income Tax?

Overall, whether or not living in a no-income-tax state is right for you depends on your individual circumstances. If you are a high earner and do not mind paying higher sales and property taxes, then living in a no-income-tax state may be a good option for you. However, if you are concerned about the quality of public services in your state or rely on local government services, you may want to consider living in a state with an income tax.

Here are some additional things to consider when making your decision:

Your income level

If you have a low to moderate income, you may not save a lot of money by living in a no-income-tax state, especially if you have dependents.

Your spending habits

If you spend a lot of money on goods and services that are subject to sales tax, you may end up paying more in sales tax than you would in a state with an income tax.

Your priorities

If you value public services such as education and infrastructure, you may want to live in a state with an income tax, even if it means paying more taxes.

It is also important to note that the tax laws in each state are constantly changing, so it is important to do your own research before making a decision.

© 2026 ideal-LIVING Magazine • 265 Racine Dr #201 • Wilmington, NC 28403 • 910.763.2100